Planning a no-spend month is a bold yet rewarding financial exercise that can reset your habits, clarify your priorities, and strengthen your discipline. It’s not just about cutting costs—it’s about becoming more intentional with your money and learning to distinguish between needs and wants. For many, the idea of not spending beyond essentials for an entire month sounds restrictive, but when approached thoughtfully, it can be surprisingly liberating. The process begins with a clear understanding of your financial landscape and a commitment to redefining your relationship with consumption.

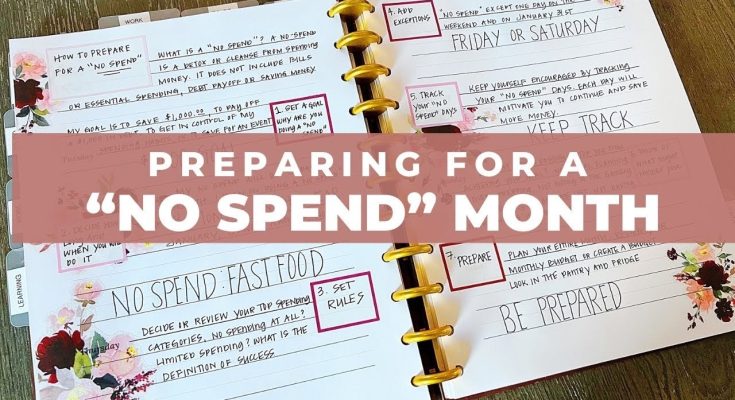

Before diving into a no-spend month, it’s important to establish what “no-spend” actually means for you. The concept isn’t one-size-fits-all. For some, it may involve eliminating all discretionary purchases, including dining out, entertainment, and shopping. For others, it might mean pausing only specific categories of spending that tend to spiral out of control. The goal is to create boundaries that are challenging but realistic. If you’re running a business, for instance, you might exclude operational expenses but commit to avoiding non-essential upgrades or impulse buys. The clarity of your definition sets the tone for the entire month and helps avoid confusion or frustration later on.

Once you’ve defined your parameters, the next step is preparation. A successful no-spend month doesn’t happen by accident—it requires planning. This means taking stock of what you already have, anticipating upcoming needs, and setting up systems to support your goals. If you know you’ll need groceries, plan meals around what’s already in your pantry and make a list that sticks strictly to essentials. If you anticipate social events, consider how you’ll participate without spending, whether by suggesting free activities or simply being transparent about your challenge. Preparation also includes communicating with others who might be affected, such as family members or business partners, so that expectations are aligned and support is available.

Mindset plays a crucial role throughout the process. A no-spend month is not a punishment—it’s a practice in mindfulness and resourcefulness. Shifting your perspective from deprivation to opportunity can make a significant difference. Instead of focusing on what you’re giving up, consider what you’re gaining: clarity, control, and a deeper understanding of your financial behavior. This mindset shift can be especially powerful in a business context, where spending often becomes habitual or reactive. By pressing pause, you create space to evaluate whether each expense truly adds value or simply fills a perceived gap.

Tracking progress is essential to staying motivated. Whether you use a spreadsheet, an app, or a simple journal, documenting your experience helps reinforce accountability and provides insight into patterns. You might notice that certain days are harder than others, or that specific triggers prompt the urge to spend. These observations are valuable, not just for the current challenge but for long-term financial planning. In a business setting, tracking can reveal inefficiencies or highlight areas where lean operations are possible without sacrificing quality. The data you gather during a no-spend month can inform smarter decisions moving forward.

Flexibility is also important. Life is unpredictable, and rigid rules can sometimes backfire. If an unexpected expense arises that falls outside your original plan, don’t view it as failure. Instead, assess the situation, make a thoughtful decision, and adjust your approach if necessary. The purpose of a no-spend month is growth, not perfection. Being adaptable allows you to maintain momentum without becoming discouraged. For example, if a client meeting requires travel or a family emergency demands attention, responding responsibly is more important than adhering strictly to the challenge.

Reflection at the end of the month is where the real value emerges. Take time to review what worked, what didn’t, and what surprised you. Did you discover new ways to enjoy your time without spending? Did you uncover habits that no longer serve you? Were there moments when you felt empowered by your choices? These insights can shape future financial strategies and reinforce the benefits of intentional living. For businesses, this reflection might lead to revised budgets, streamlined operations, or a renewed focus on ROI. For individuals, it can inspire ongoing habits that support savings, investment, or debt reduction goals.

Ultimately, planning a no-spend month is about more than just saving money—it’s about reclaiming control. It’s a deliberate pause in a world that constantly encourages consumption, offering a chance to reset and realign. Whether you’re managing a household, running a business, or simply seeking greater financial clarity, the experience can be transformative. It teaches discipline, fosters creativity, and builds resilience. And while the month may end, the lessons often linger, shaping how you approach spending, saving, and decision-making long after the challenge is complete.