Smart decision-making is often described as the ability to weigh risks against rewards and choose a path that maximizes opportunity while minimizing potential harm. Insurance plays a subtle but powerful role in shaping this process. By providing a safety net against uncertainty, insurance allows individuals and businesses to make decisions with greater confidence, knowing that the consequences of unforeseen events will not completely derail their plans. It is not simply about covering losses; it is about enabling choices that might otherwise feel too risky to pursue.

One of the most important ways insurance influences decision-making is by reducing the fear of the unknown. When people are faced with uncertainty, they often hesitate to act, even if the potential rewards are significant. Insurance transforms that hesitation into action by absorbing the financial impact of setbacks. This shift allows individuals to pursue opportunities—whether buying a home, starting a business, or investing in growth—without being paralyzed by the possibility of loss. The presence of insurance changes the calculus, making bold decisions more rational and less daunting.

Health insurance provides a clear example of how coverage shapes choices. Without it, individuals may delay medical care or avoid preventive measures due to cost concerns. With insurance, the decision to seek treatment becomes easier and more immediate, protecting both health and financial stability. This proactive approach not only improves outcomes but also reinforces the importance of making decisions based on long-term well-being rather than short-term financial strain. Insurance, in this sense, encourages smarter choices by aligning health priorities with financial security.

Property insurance has a similar effect on decision-making. Owning or expanding assets such as homes, vehicles, or business facilities involves significant investment. The risk of damage from accidents, theft, or natural disasters can make these decisions feel overwhelming. Insurance provides reassurance that these assets are protected, allowing individuals and organizations to move forward with confidence. This protection enables smarter investment decisions, as the risk of catastrophic loss is mitigated, making growth strategies more sustainable.

Life insurance adds another dimension by shaping decisions about legacy and long-term planning. Families often face difficult choices about how to allocate resources for education, retirement, or generational wealth transfer. Life insurance ensures that these goals remain achievable even in the face of tragedy. It provides continuity, allowing families to plan with clarity and confidence. This assurance encourages smarter financial decisions, as individuals can allocate resources toward growth and opportunity without constantly worrying about what might happen if the unexpected occurs.

For businesses, insurance is often the difference between cautious hesitation and strategic expansion. Companies operate in environments filled with risks, from liability claims to supply chain disruptions. Without coverage, leaders may avoid opportunities that involve uncertainty, limiting innovation and growth. With insurance, those risks become manageable, enabling businesses to make smarter decisions about entering new markets, launching products, or investing in infrastructure. Insurance acts as a stabilizer, allowing organizations to balance ambition with responsibility.

The psychological impact of insurance is equally important in shaping decision-making. Fear and anxiety often cloud judgment, leading to overly conservative choices or missed opportunities. Knowing that coverage exists alleviates this burden, fostering confidence in pursuing goals. Families can invest in their children’s future, professionals can take career risks, and entrepreneurs can launch ventures without being paralyzed by fear of loss. Insurance provides peace of mind, turning risk into something manageable and empowering people to make decisions based on potential rather than fear.

Insurance also encourages responsibility by incentivizing safer practices. Premiums often reflect risk levels, motivating individuals to adopt healthier lifestyles, maintain safe homes, or drive responsibly. Businesses may implement stronger safety protocols to reduce liability exposure. These behaviors not only reduce the likelihood of claims but also strengthen resilience overall. Insurance, in this sense, is not just reactive but proactive, shaping habits that minimize risks before they materialize. This proactive influence leads to smarter decision-making by aligning choices with long-term stability.

Adaptability enhances the role of insurance in guiding decisions. Policies can be tailored to fit specific needs, ensuring that coverage aligns with evolving circumstances. As life changes—through marriage, children, career shifts, or new investments—insurance evolves alongside it. This flexibility ensures that protection remains relevant, reinforcing the sense of control that stability requires. Families and businesses gain confidence knowing that their coverage can adjust to whatever challenges the future may bring, making decisions smarter and more sustainable.

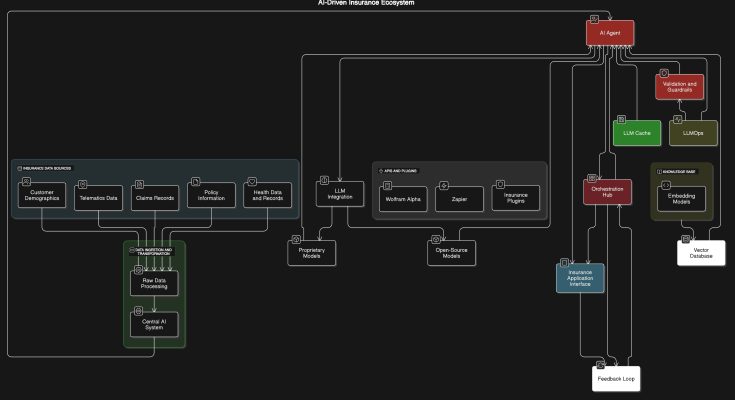

Technology has amplified the effectiveness of insurance in recent years, further shaping decision-making. Digital platforms make it easier to access, manage, and understand policies. Mobile apps allow customers to file claims instantly, track coverage, and receive updates in real time. This transparency reduces uncertainty and builds trust, ensuring that insurance feels integrated into everyday life rather than a distant obligation. In a fast-paced world, convenience and clarity are essential, and technology ensures that insurance delivers both, reinforcing smarter choices.

Insurance also contributes to broader community resilience, which indirectly supports individual decision-making. By pooling risk across large groups, insurers prevent financial shocks from overwhelming societies. This collective resilience fosters recovery after crises and creates an environment where families and businesses can thrive. Confidence in communities is built on the assurance that risks are shared and managed collectively, and insurance plays a central role in providing that assurance. This stability encourages smarter decisions at every level, from households to corporations.

The link between insurance and long-term planning is particularly strong. Retirement strategies, estate planning, and wealth transfer often incorporate insurance as a key component. Life insurance ensures that legacies are preserved, while health and long-term care coverage protect against expenses that could erode savings. These considerations allow individuals to plan with clarity, confident that their efforts will not be undone by unexpected challenges. Insurance provides the continuity needed to sustain stability across generations, reinforcing the importance of smart, forward-looking decisions.

Ultimately, insurance empowers people to live more fully while making choices that align with their ambitions. It reduces the weight of uncertainty, allowing individuals and businesses to pursue opportunities, take risks, and enjoy life without constant fear of financial ruin. Peace of mind is not just about avoiding stress; it is about creating the freedom to focus on what truly matters. Insurance provides that freedom, transforming risk into resilience and instability into stability.

In the end, insurance shapes smart decision-making by safeguarding assets, supporting income, managing liabilities, and fostering trust. It enables bold decisions, encourages responsible practices, and ensures continuity in times of disruption. By viewing insurance as more than a requirement, individuals and organizations can appreciate its role as a cornerstone of resilience and prosperity. It is not simply about covering risks but about shaping a future where choices can be made with clarity, confidence, and strength.