Insurance is one of those financial tools that people often misunderstand, and misconceptions can lead to costly mistakes. Many individuals assume that simply having a policy in place is enough, but the reality is that the details matter. Believing in myths about insurance can leave you underprotected, overpaying, or facing unexpected financial burdens when you least expect them. Understanding the truth behind these myths is essential for making smarter decisions and safeguarding your financial future.

One common myth is that the cheapest policy is always the best option. While saving money on premiums may seem appealing, low-cost coverage often comes with significant limitations. Policies with minimal coverage can leave you exposed to risks that far outweigh the savings. When an accident or emergency occurs, the out-of-pocket expenses can be devastating. Choosing insurance based solely on price ignores the importance of adequate protection, and the hidden costs of insufficient coverage can quickly add up.

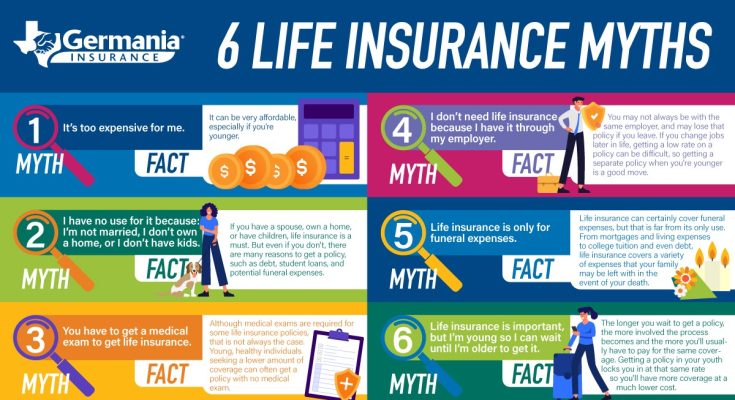

Another widespread misconception is that employer-provided insurance is enough. Many people rely entirely on the coverage offered through their workplace, assuming it will meet all their needs. In reality, employer plans often provide only basic protection, leaving gaps in areas such as life insurance, disability coverage, or supplemental health benefits. Without reviewing and supplementing these policies, individuals may find themselves vulnerable to financial strain if unexpected events occur. Believing that employer coverage is comprehensive can create a false sense of security.

A related myth is that young and healthy individuals don’t need insurance. It is easy to think that coverage is unnecessary when you are in good health or early in your career. However, accidents and illnesses can happen at any age, and the financial consequences can be severe. Insurance is not just about current health but about protecting against unforeseen risks. Waiting until later in life often means higher premiums and fewer options, making early coverage both practical and cost-effective.

Many people also believe that insurance is only useful for large, catastrophic events. While it certainly provides protection in those scenarios, insurance also covers smaller, everyday risks that can disrupt financial stability. Car accidents, minor health issues, or property damage may not seem catastrophic, but the costs can still be significant. Assuming that insurance is only for rare disasters overlooks its role in managing routine risks and maintaining financial balance.

Another costly myth is that all insurance policies are essentially the same. In reality, coverage varies widely depending on the provider, the policy terms, and the specific needs of the individual. Two policies with similar premiums may offer very different levels of protection. Failing to read the fine print or compare options can result in inadequate coverage or unexpected exclusions. Treating insurance as a one-size-fits-all product can lead to expensive surprises when it comes time to file a claim.

Some people assume that once they purchase insurance, they never need to revisit it. This belief can be particularly damaging, as life circumstances change over time. Marriage, children, new property, or career shifts all affect insurance needs. A policy that was sufficient five years ago may no longer provide adequate protection today. Ignoring the need to update coverage can leave individuals underinsured and financially exposed. Insurance should be reviewed regularly to ensure it evolves alongside personal and professional changes.

There is also a misconception that insurance companies will always cover claims without issue. While insurers are designed to provide protection, claims are subject to the terms of the policy. Exclusions, deductibles, and coverage limits all play a role in determining what is paid out. Assuming that every claim will be approved can lead to disappointment and financial hardship. Understanding the specifics of your policy is essential to avoid costly misunderstandings.

Another myth is that insurance is only about financial protection. While money is a central aspect, insurance also provides peace of mind and confidence. Knowing that risks are managed allows individuals and businesses to make decisions without constant fear of financial ruin. This psychological benefit is often overlooked, yet it plays a crucial role in stability and growth. Dismissing insurance as purely financial misses its broader impact on well-being and opportunity.

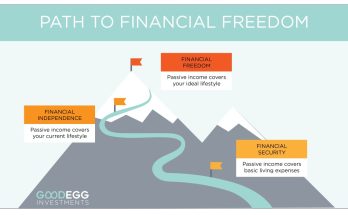

Some believe that insurance is unnecessary if they have strong savings. While savings are important, they are not a substitute for coverage. A single medical emergency, lawsuit, or disaster can wipe out years of savings in an instant. Insurance ensures that savings remain intact for long-term goals rather than being consumed by unexpected expenses. Relying solely on savings exposes individuals to risks that insurance is specifically designed to mitigate.

Finally, there is the myth that insurance is a burden rather than an asset. Premiums may feel like an expense, but they are an investment in security and resilience. Insurance protects against losses that could derail financial plans, making it a critical component of stability. Viewing it as a burden overlooks its role in enabling growth, protecting assets, and supporting confidence in decision-making. The cost of premiums is small compared to the potential financial devastation of being uninsured or underinsured.

In the end, the myths surrounding insurance can be costly if left unchallenged. Believing that coverage is unnecessary, interchangeable, or sufficient without review creates vulnerabilities that undermine financial stability. Insurance is not just about protection; it is about empowerment, resilience, and opportunity. By dispelling these misconceptions and approaching insurance with clarity, individuals and businesses can make smarter choices that safeguard their futures and prevent unnecessary financial strain.